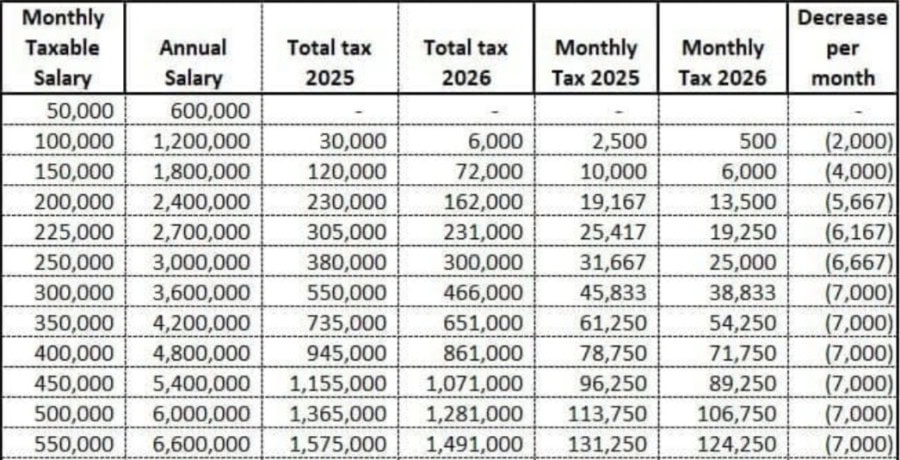

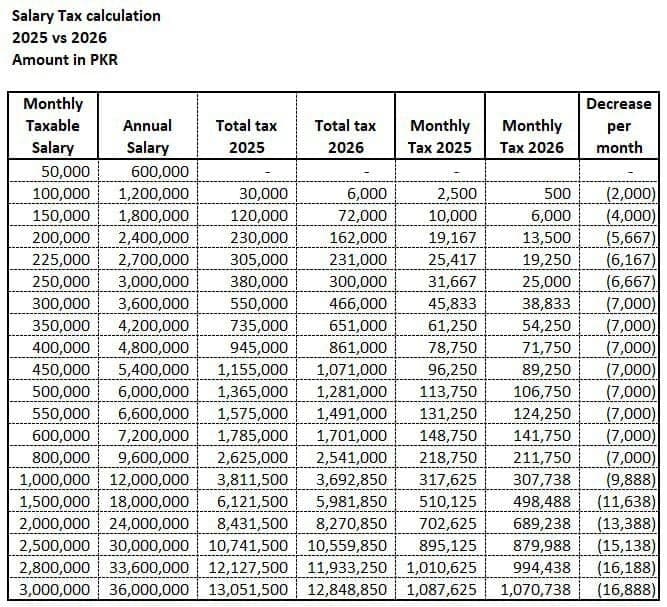

ISLAMABAD – The federal government has announced a notable reduction in income tax for the salaried class, set to take effect from July 2025 in news fiscal year 2026.

The revised tax structure will provide relief to millions of wage earners across various income brackets, with monthly savings ranging from Rs2,000 to over Rs16,000.

The new tax policy outlines lower annual and monthly tax obligations for individuals earning taxable salaries from Rs50,000 to Rs3,000,000 per month. The move is being welcomed as a much-needed measure to ease financial pressure amid ongoing inflation and economic uncertainty.

Lower Income Brackets Benefit Significantly

Individuals earning Rs100,000 per month will now pay only Rs6,000 annually in taxes in FY2025-26, compared to Rs30,000 in FY2024-2025—a monthly reduction of PKR 2,000.

Similarly, those earning Rs150,000 per month will see their monthly tax drop from Rs10,000 in FY2024-25 to Rs6,000 in FY2025-26.

Middle-Income Relief

Salaried individuals earning Rs300,000 per month will now pay Rs38,833 in monthly tax in FY2025-26, down from Rs45,833 in FY2024-25.

For those earning PKR 600,000 per month, the monthly tax falls from Rs113,750 to Rs106,750 in upcoming fiscal year.

Tax High-Income Earners

Professionals with a Rs1 million monthly salary will benefit from a Rs7,000 monthly reduction, while top earners with Rs3 million per month will see a drop of Rs16,888.

According to government officials, the new tax regime aims to stimulate economic growth by increasing disposable income for salaried individuals, which in turn is expected to boost consumer spending and investment.

The 2026 tax reform is being perceived as a major step toward addressing the growing concerns of the salaried middle class, which has long expressed dissatisfaction with rising living costs and static incomes.

Read the Complete Table Below

| Monthly Taxable Salary | Annual Salary | Total Tax 2025 | Total Tax 2026 | Monthly Tax 2025 | Monthly Tax 2026 | Decrease per Month |

|---|---|---|---|---|---|---|

| 50,000 | 600,000 | – | – | 2,500 | 500 | (2,000) |

| 100,000 | 1,200,000 | 30,000 | 6,000 | 2,500 | 500 | (2,000) |

| 150,000 | 1,800,000 | 120,000 | 72,000 | 10,000 | 6,000 | (4,000) |

| 200,000 | 2,400,000 | 230,000 | 162,000 | 19,167 | 13,500 | (5,667) |

| 225,000 | 2,700,000 | 305,000 | 231,000 | 25,417 | 19,250 | (6,167) |

| 250,000 | 3,000,000 | 380,000 | 300,000 | 31,667 | 25,000 | (6,667) |

| 300,000 | 3,600,000 | 550,000 | 466,000 | 45,833 | 38,833 | (7,000) |

| 350,000 | 4,200,000 | 735,000 | 651,000 | 61,250 | 54,250 | (7,000) |

| 400,000 | 4,800,000 | 942,000 | 861,000 | 78,750 | 71,750 | (7,000) |

| 450,000 | 5,400,000 | 1,155,000 | 1,071,000 | 96,250 | 89,250 | (7,000) |

| 500,000 | 6,000,000 | 1,365,000 | 1,281,000 | 113,750 | 106,750 | (7,000) |

| 550,000 | 6,600,000 | 1,575,000 | 1,491,000 | 131,250 | 124,250 | (7,000) |

| 600,000 | 7,200,000 | 1,785,000 | 1,701,000 | 148,750 | 141,750 | (7,000) |

| 800,000 | 9,600,000 | 2,625,000 | 2,541,000 | 218,750 | 211,750 | (7,000) |

| 1,000,000 | 12,000,000 | 3,465,000 | 3,381,000 | 288,750 | 281,750 | (7,000) |

| 1,500,000 | 18,000,000 | 5,961,000 | 5,881,850 | 496,750 | 490,154 | (6,596) |

| 2,000,000 | 24,000,000 | 8,431,500 | 8,270,850 | 702,625 | 689,238 | (13,388) |

| 2,500,000 | 30,000,000 | 10,247,500 | 10,041,850 | 853,958 | 836,821 | (17,137) |

| 3,000,000 | 36,000,000 | 13,051,500 | 12,848,850 | 1,087,625 | 1,070,738 | (16,888) |

DATE . June/13/2025